Buy now pay later payment gateways have become increasingly popular in recent years. This type of gateway allows customers to make purchases without having to pay for them immediately. Instead, they can choose to pay for the purchase over time, often in installments. This can be a great option for customers who want to make a large purchase but may not have the funds available to pay for it all at once. There are a few different buy now pay later payment gateways available, so it is important to do some research to find the one that best suits your needs.

What is buy now pay later?

Buy now pay later is a payment gateway that allows you to make purchases and then pay for them later. This can be helpful if you need to make a purchase but don’t have the funds immediately available.

A Buy Now Pay Later Payment Gateway is a type of payment gateway that allows you to defer payment for a purchase until a later date. This can be useful if you need to make a purchase but do not have the funds available immediately.

There are a few different options available when it comes to Buy Now Pay Later Payment Gateways. Some allow you to defer payment for a set period of time, while others may allow you to make interest-free payments over time. There may also be different minimum purchase amounts required in order to qualify for the deferred payment option.

There are a few things to keep in mind if you’re considering using a buy now pay later payment gateway. First, make sure you understand the terms and conditions of the Gateway. Some gateways will charge interest on the purchase, so be sure to factor that into your decision.

Second, remember that you will still need to pay for the purchase eventually. Make sure you have a plan in place to repay the amount you owe.

Benefits of buy now pay later

Buy now pay later payment gateways are one of the most used online payment methods. Advantages of buy now pay later are:

-You can increase your sales by allowing your customers to buy your products now and pay later.

-It’s a great way to finance your purchases, as you can spread the cost over a period of time that suits you.

-It can help you to budget better, as you know exactly how much you need to pay each month.

-You can avoid interest charges by making sure you pay off the balance within the interest-free period.

-Increased Sales and Conversions, By offering a Buy Now Pay Later gateway on your site, you can increase your overall sales and conversion rates. This is because customers are more likely to make a purchase when they have the option to pay later.

-It’s a convenient way to shop, as you can make your purchases immediately and pay for them later.

There are many reasons to choose a Buy Now Pay Later gateway for your eCommerce website. By offering this option to your customers, you can provide them with a greater sense of flexibility and control when it comes to their purchase. In addition, this type of gateway can also help to increase your overall sales and conversion rates. Here are just a few of the many benefits that you can enjoy by offering a Buy Now Pay Later gateway on your site.

How does a Buy now pay later program work?

Assuming you would like a blog post discussing buy now, pay later payment gateways.

Buy now, pay later payment gateways allow customers to make a purchase and then pay for it at a later date. This can be a useful option for customers who may not have the funds available at the time of purchase, or who simply want to spread out the cost of a purchase.

There are a few different ways that buy now, pay later payment gateways can work. Some allow customers to make a purchase and then pay for it over time, with interest. Others allow customers to make a purchase and then pay for it in full at a later date, with no interest charged.

buy now pay later payment gateway works by allowing customers to make online purchases and then deferring the payments for a set period of time. This can be a useful tool for budgeting or for making large purchases without having to immediately come up with the full amount of money. There are a few things to keep in mind when using a buy now pay later payment gateway.

First, it is important to read all the guidelines of the pay later app before making a purchase. Some app gateways may charge interest or fees for late payments, so it is important to know what those charges may be. It is also important to make sure that the purchase can be made within the deferral period. Otherwise, the customer may be responsible for paying on time.

Where to find buy now pay later payment gateways

There are a few places that you can look for buy now pay later payment gateways. You can try Google. You can also check out websites that specialize in this type of thing. Another option is to ask your bank or credit card company if they offer any type of buy now pay later payment gateway.

If you are looking for a buy now pay later payment gateway, there are a few things that you should keep in mind. First, you want to make sure that the gateway is secure. You also want to make sure that it is compatible with your bank or credit card company. You also want to make sure that you will be able to use the gateway with your billing software.

Buy now pay later payment gateways are a great way to shop as usual and then pay for your purchase over time. Afterpay is one of the most popular options, and it’s available at many online retailers.

What is the option of Buy now pay later?

Here are top most used after pay gateways,

Afterpay

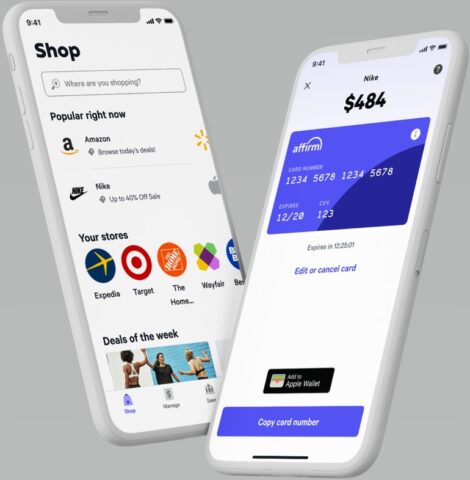

Affirm

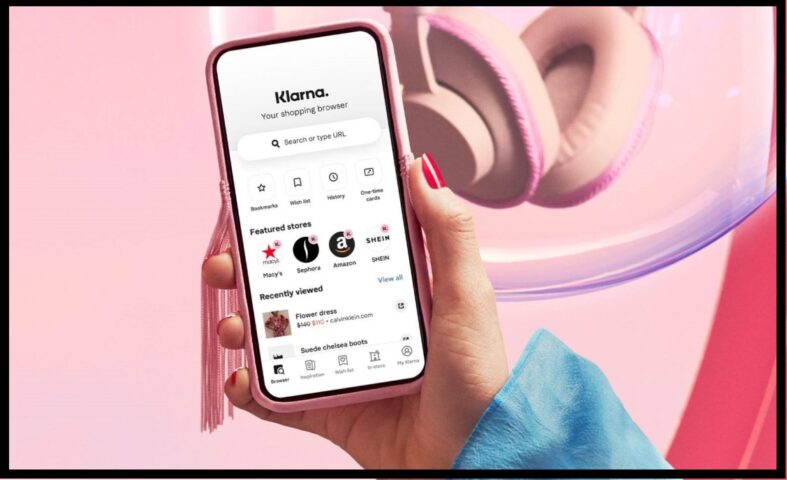

Klarna

Sezzel

There are many different Buy now pay later payment gateways available for online shoppers. Some of the most popular ones include Afterpay, Klarna, and QuadPay. These payment gateways allow shoppers to split their purchase into four equal payments, spread out over a period of time. This can be helpful for those who may not have the full amount of the purchase available at the time of checkout. It can also help to avoid interest charges on credit cards.

How does Buy now pay later work?

Buy now pay later is a type of payment gateway that allows customers to purchase items now and pay for them later. This type of gateway is becoming increasingly popular, as it allows customers to buy items they may not be able to afford upfront. There are a few different ways that buy now pay later payment gateways work.

One common way is that the customer is given a set period of time to pay back the purchase price, without any interest or fees. This can be a great option for those who need to purchase an item but may not have the funds available at the time. Another way buy now pay later works is by the customer paying a small deposit upfront, with the remainder of the purchase price being due at a later date.

Some online retailers that offer Buy now pay later payment gateways include ASOS, Forever 21, and Target. There are also many smaller online stores that offer this type of payment option. When shopping online, be sure to look for the Buy now pay later logo at checkout.

About Afterpay

Buy now pay later payment gateway options have been growing in popularity in recent years. Afterpay is one such option that allows customers to buy now and pay later in four equal installments, interest-free.

This can be a great option for online shoppers who want to make a purchase but may not have the funds available at the time.

There are a few things to keep in mind when using Afterpay, however. First, shoppers must be sure that they will be able to afford the installments.

If not, they may end up with late fees and interest charges. Secondly, it’s important to remember that Afterpay is not a line of credit. Shoppers can only use it for purchases made through participating retailers.

There is no doubt that buy now pay later payment gateways are becoming increasingly popular. With the ability to offer customers the convenience of immediate purchase and the flexibility of delayed payment, these gateways are a win-win for both businesses and consumers. If you’re looking to increase sales and customer satisfaction, implementing a buy now pay later gateway is a great way to do it.

In conclusion, buy now pay later payment gateways are a great way to make purchases without having to pay upfront. However, it is important to be aware of the potential risks involved in using these types of payment gateways. Make sure you understand the terms and conditions before using a buy now pay later payment gateway, and always make sure you can afford the monthly repayments.

There are a number of different BNPL payment gateways available, each with their own advantages and disadvantages. Ultimately, the best gateway for your business will depend on your specific needs and requirements. Do your research and carefully consider all your options before making a decision.

Leave a Reply