Forex pips amount calculator

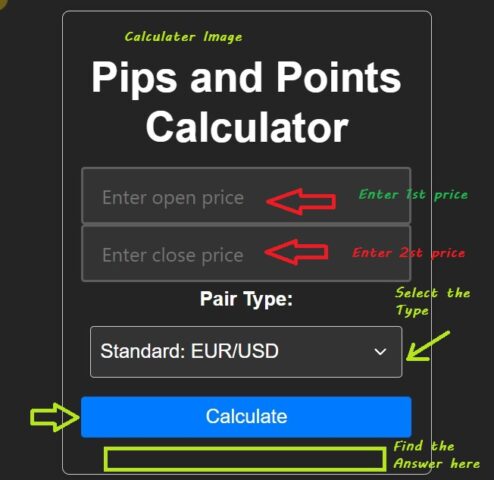

Pips and Points Calculator

Forex pips diffrance pip amount calculator

A Forex pips amount calculator is a valuable tool that helps traders determine the monetary value of each pip in their trades, depending on the currency pair being traded and the size of their position. By inputting the relevant details such as the currency pair and the lot size, traders can quickly assess how much they stand to gain or lose with each pip movement in the market.

This calculation is crucial for effective risk management and position sizing, enabling traders to make informed decisions and strategize their trades better. Utilizing such a calculator can significantly enhance a trader’s overall performance and confidence in their trading approach.

A Forex pip amount calculator is a useful tool for traders to determine the monetary value of a pip based on the currency pair they are trading. By inputting the trade size and the currency pair, traders can effectively manage their risk and set appropriate stop-loss levels. This ensures that they are making informed decisions based on their account balance and risk tolerance. Using a pip calculator can significantly enhance a trader’s overall strategy and performance in the volatile Forex market.

it allows traders to adjust their position sizes accurately, ensuring they capitalize on profitable opportunities while minimizing potential losses. By incorporating this tool into their trading routine, traders can foster a more disciplined and systematic approach to Forex trading.

Forex pips amount calculator

Understanding how to utilize a pip calculator can empower traders to make better predictions about their trades’ potential outcomes. This level of preparation not only boosts their confidence but also increases their chances of long-term success in the Forex market & tax.

Analyzing past trades and using a pip calculator effectively, traders can refine their strategies and enhance their overall performance.

Continuous learning and adaptation are key components to thriving in the ever-evolving landscape of Forex trading. As traders become more proficient in using analytical tools, they will be able to respond more adeptly to market fluctuations. This proactive mindset enables them to seize opportunities that may have otherwise gone unnoticed.

Title: Mastering Forex Trading with Essential Calculators: A Comprehensive Guide

In the fast-paced world of forex trading, having the right tools at your disposal can make all the difference in your success. Calculators are essential resources that help traders analyze various aspects of their trades, manage risk, and make informed decisions. In this article, we will delve into the top forex calculators that you can use to check pip amounts, calculate risk and reward ratios, determine lot sizes, and set stop losses effectively.

- Pip Calculator:

The pip calculator is a fundamental tool for forex traders to calculate the value of a pip in their chosen currency pair. Pips represent the smallest price movement in the forex market, and understanding their value is crucial for assessing profit and loss. By entering the currency pair, trade size, and pip value, the pip calculator can determine the monetary value of each pip movement, helping traders manage their positions more effectively. - Risk and Reward Calculator:

Managing risk is a key aspect of successful forex trading, and the risk and reward calculator is a valuable tool for evaluating potential trade setups. This calculator allows traders to input their entry price, stop loss level, and target price to calculate the risk-to-reward ratio of a trade. By analyzing the potential profit compared to the risk involved, traders can make more informed decisions and ensure proper risk management in their trading strategies. - Lot Size Calculator:

Determining the appropriate lot size for each trade is essential for managing risk and maximizing profit potential. The lot size calculator helps traders calculate the optimal position size based on their account size, risk tolerance, and trade setup. By inputting factors such as account balance, risk percentage per trade, and stop loss distance, traders can identify the ideal lot size that aligns with their risk management strategy and trading goals. - Stop Loss Calculator:

Setting effective stop loss levels is crucial for protecting capital and minimizing losses in forex trading. The stop loss calculator helps traders determine the appropriate stop loss distance based on factors such as entry price, risk percentage per trade, and account balance. By calculating the stop loss level in pips or currency units, traders can establish a disciplined approach to risk management and avoid emotional decision-making during trades.

In conclusion, forex calculators are indispensable tools that provide traders with the necessary calculations and insights to make informed trading decisions. Whether you are a beginner or an experienced trader, utilizing these calculators can enhance your risk management strategies, optimize position sizing, and improve overall trading performance. By incorporating these essential calculators into your trading routine, you can navigate the complexities of the forex market with confidence and precision. Embrace the power of forex calculators and elevate your trading journey to new heights of success. Happy trading!