Table of Contents

How To Buy Stocks Online SAFELY With an Online Broker

Investing in stocks can be an exciting way to grow your wealth, but it’s important to do it safely. With so many online brokers available, knowing how to choose the right one and protect your money is crucial. This guide will walk you through the steps to buy stocks online safely with a trusted online broker. Whether you’re a beginner or an experienced investor, these tips will help you make informed decisions and avoid common pitfalls.

Why Safety Matters When Buying Stocks Online

When you (use this stock screener) buy stocks online, you’re trusting an online broker with your hard-earned money. A safe online broker ensures your funds are secure, your personal information is protected, and your trades are executed fairly.

Here’s why safety should be your top priority:

- Protects your money from fraud or scams

- Ensures your personal data is secure

- Provides a reliable platform for trading

The rise of online trading has made it easier than ever to invest, but it has also attracted scammers and fraudulent platforms. That’s why learning how to buy stocks online safely is essential.

How to Choose a Safe Online Broker for Stock Trading

Not all online brokers are created equal. Here’s how to find one that prioritizes safety:

1. Check for Regulation and Licensing

Always verify that the broker is regulated by a reputable authority, such as the SEC (U.S. Securities and Exchange Commission) or FCA (Financial Conduct Authority). Regulation ensures the broker follows strict guidelines to protect investors.

2. Look for Strong Security Features

A safe online broker will use encryption, two-factor authentication, and other security measures to protect your account. Look for brokers that offer these features to safeguard your money and personal information.

3. Read Reviews and Ratings

Research what other users are saying. Look for brokers with high ratings and positive feedback about their safety and reliability. Websites like Trustpilot and the Better Business Bureau can provide valuable insights.

4. Evaluate Fees and Transparency

A trustworthy broker will be upfront about their fees. Avoid brokers with hidden charges or unclear pricing structures. Transparency is a key indicator of a safe online broker.

5. Test Customer Support

Reliable customer support is a sign of a safe online broker. Test their responsiveness before opening an account. A broker with 24/7 support is ideal, especially if you’re new to trading.

Steps to Buy Stocks Online Securely

Once you’ve chosen a safe online broker, follow these steps to buy stocks securely:

1. Open an Account

Provide the required information and complete the verification process. This usually involves submitting identification documents to comply with regulations.

2. Deposit Funds

Transfer money into your account using a secure payment method. Most brokers accept bank transfers, credit cards, and even digital wallets.

3. Research Stocks

Use the broker’s tools and resources to analyze stocks before investing. Look for companies with strong financials, a good track record, and growth potential.

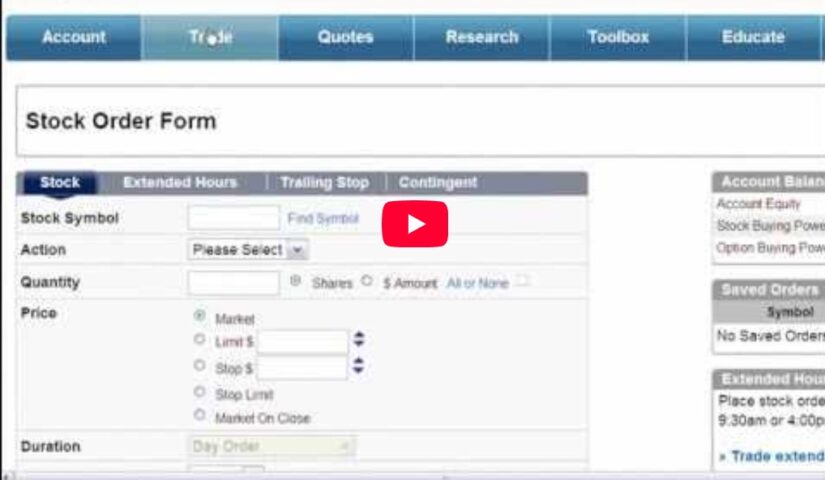

4. Place Your Order

Choose between market orders, limit orders, or other types of trades. A market order buys the stock immediately at the current price, while a limit order sets a specific price at which you’re willing to buy.

5. Monitor Your Investments

Keep an eye on your portfolio and make adjustments as needed. Regular monitoring helps you stay on top of market trends and make informed decisions.

How to Avoid Scams When Buying Stocks Online

Scams are a real risk when trading online. Here’s how to protect yourself:

- Avoid brokers with unrealistic promises (e.g., guaranteed high returns). If it sounds too good to be true, it probably is.

- Never share your login details with anyone. Legitimate brokers will never ask for your password.

- Be cautious of unsolicited investment offers. Scammers often use cold calls or emails to lure victims.

- Use strong, unique passwords for your trading account. Combine letters, numbers, and symbols to create a secure password.

Top-Rated Online Brokers for Safe Stock Investments

Here are some brokers known for their safety and reliability:

- Charles Schwab: Great for beginners and experienced traders alike. Offers a wide range of investment options and excellent customer support.

- Fidelity: Known for its low fees and user-friendly platform. Ideal for long-term investors.

- E*TRADE: Offers a robust trading platform with strong security features. Perfect for active traders.

For Canadians’

- Wealthsimple: Official recommendation here Provides a wide range of tools and educational resources. Great for those who want to learn while they invest.

What to Look for in a Safe Online Stock Broker

When choosing an online broker, consider the following factors:

- Regulation: Ensure the broker is regulated by a reputable authority.

- Fees: Look for brokers with low, transparent fees.

- Ease of Use: A user-friendly platform makes trading easier, especially for beginners.

- Customer Support: Reliable support is essential for resolving issues quickly.

- Educational Resources: Brokers that offer tutorials, webinars, and articles can help you become a better investor.

How to Protect Your Money When Buying Stocks Online

Protecting your money is just as important as choosing the right broker. Here are some tips:

- Diversify Your Portfolio: Don’t put all your money into one stock. Spread your investments across different sectors to reduce risk.

- Set a Budget: Only invest money you can afford to lose. This helps you avoid financial stress.

- Use Stop-Loss Orders: This feature automatically sells a stock if it drops below a certain price, limiting your losses.

- Stay Informed: Keep up with market news and trends to make informed decisions.

Final Thoughts

Buying stocks online can be a rewarding experience if you take the right precautions. By choosing a safe online broker and following best practices, you can protect your money and make informed investment decisions.

Ready to start your investing journey? Take the first step today by researching safe online brokers and opening an account.

Test your memory 🤔 Questions:

- What’s the most important factor you look for in an online broker?

- Have you ever encountered a scam while trading online? Share your experience in the comments!

FAQ Section

1. How do I know if an online broker is safe?

Look for regulation, strong security features, and positive user reviews.

2. What are the best online brokers for beginners?

Charles Schwab, Fidelity, and E*TRADE are great options for beginners.

3. How much money do I need to start buying stocks online?

Many brokers allow you to start with as little as $0, but some require a minimum deposit.

4. Can I lose money when buying stocks online?

Yes, investing in stocks carries risks, and it’s possible to lose money.

5. How do I protect my personal information when trading online?

Use strong passwords, enable two-factor authentication, and avoid sharing your login details.

6. Are there fees for buying stocks online?

Yes, most brokers charge fees, but they vary. Look for brokers with low, transparent fees.