A Guide for Investing & Trading

How to Use Momentum and Velocity, When it comes to trading and investing, understanding key concepts like momentum and velocity can make a significant difference in your success. These tools help you identify trends, spot opportunities, and make informed decisions. In this article, we’ll explore how to use momentum and velocity in trade, discuss Dark Pool Buy Zones, and provide actionable insights to enhance your trading strategy.

Table of Contents

What Are Momentum and Velocity in Trading?

Momentum and velocity are two powerful concepts that traders use to analyze market movements. While they may sound similar, they serve different purposes in your trading toolkit.

Momentum refers to the speed at which an asset’s price is moving in a particular direction. It helps you determine whether a trend is strong or weakening. For example, if a stock’s price is rising rapidly, it has strong upward momentum.

Velocity, on the other hand, measures the rate of change in momentum. It tells you how quickly the momentum is accelerating or decelerating. Velocity can help you predict potential reversals or continuations in price trends.

Together, momentum and velocity provide a deeper understanding of market dynamics, allowing you to time your trades more effectively.

How to Use Momentum and Velocity in Trade

Using momentum and velocity in trade involves analyzing price movements and identifying patterns that signal potential opportunities. Here’s how you can apply these concepts:

1. Identify Trends with Momentum

Momentum indicators, such as the Relative Strength Index (RSIhttps://www.tradingview.com/scripts/relativestrengthindex/) or Moving Average Convergence Divergence (MACD), can help you spot trends. For example:

- If the RSI is above 70, it may indicate overbought conditions, suggesting a potential pullback.

- If the MACD line crosses above the signal line, it signals upward momentum.

By using these indicators, you can determine whether to enter or exit a trade based on the strength of the trend.

2. Gauge Market Strength with Velocity

Velocity helps you understand how quickly momentum is changing. For instance:

- If velocity is increasing, it suggests the trend is gaining strength.

- If velocity is decreasing, it may indicate a weakening trend or an upcoming reversal.

Combining velocity analysis with momentum indicators can give you a clearer picture of market conditions.

3. Combine Momentum and Velocity with Price Action

Price action analysis involves studying historical price movements to predict future trends. When you combine this with momentum and velocity, you can make more accurate predictions. For example:

- Look for breakouts accompanied by high momentum and velocity to confirm a strong trend.

- Use support and resistance levels to identify potential entry and exit points.

Dark Pool Buy Zones: Trading Momentum and Velocity

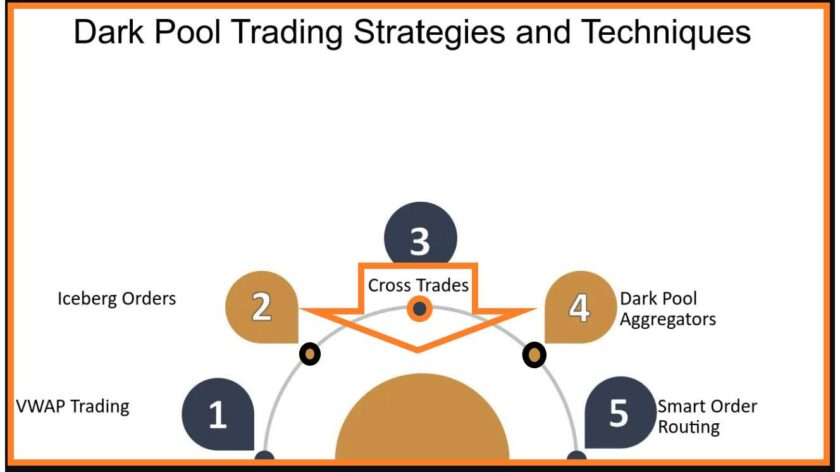

Dark Pool Buy Zones are another powerful tool for traders. Dark pools (Read this book- From Amazon) are private exchanges where institutional investors trade large blocks of securities without revealing their intentions to the public. These trades can provide valuable insights into market sentiment.

What Are Dark Pool Buy Zones?

Dark Pool Buy Zones occur when large institutional orders are executed at specific price levels. These zones often act as support or resistance levels, indicating where big players are buying or selling.

How to Use Dark Pool Buy Zones with Momentum and Velocity

- Identify Key Levels: Use Dark Pool data to identify significant buy or sell zones. These levels often align with support or resistance.

- Confirm with Momentum: Check if momentum indicators align with the Dark Pool Buy Zones. For example, if a stock is approaching a Dark Pool Buy Zone with strong upward momentum, it may signal a buying opportunity.

- Analyze Velocity: Use velocity to confirm whether the momentum is accelerating or decelerating. High velocity near a Dark Pool Buy Zone can indicate a strong move in the direction of the trend.

By combining Dark Pool Buy Zones with momentum and velocity analysis, you can gain an edge in the market and make more informed trading decisions.

Practical Tips for Using Momentum and Velocity in Trade

Here are some actionable tips to help you incorporate momentum and velocity into your trading strategy:

- Start with a Plan: Define your entry and exit points based on momentum and velocity indicators.

- Use Multiple Timeframes: Analyze momentum and velocity across different timeframes to get a broader perspective.

- Stay Disciplined: Stick to your strategy and avoid emotional decisions.

- Monitor Dark Pool Activity: Keep an eye on Dark Pool Buy Zones to identify potential support or resistance levels.

Final Thoughts

Using momentum and velocity in trade can significantly enhance your trading strategy. By understanding these concepts and combining them with tools like Dark Pool Buy Zones, you can make more informed decisions and improve your chances of success.

Start applying momentum and velocity analysis to your trades today. Experiment with different indicators and see how they can improve your results.

Questions for you.. answer on comments….

- How do you currently use momentum indicators in your trading strategy?

- Have you ever explored Dark Pool data to identify key trading levels?

Leave a Reply