Rejection Candles: A Powerful Tool for Investing and Trading

Rejection Candles, When it comes to investing and trading, understanding price action is key to making informed decisions. One of the most effective tools for analyzing price movements is the rejecte candle. These candles can provide valuable insights into market sentiment and potential reversals, helping you stay ahead of the curve. In this article, we’ll explore what rejection candle are, how to identify them, and how you can use them to improve your trading strategy.

Table of Contents

What Are Rejection Candles?

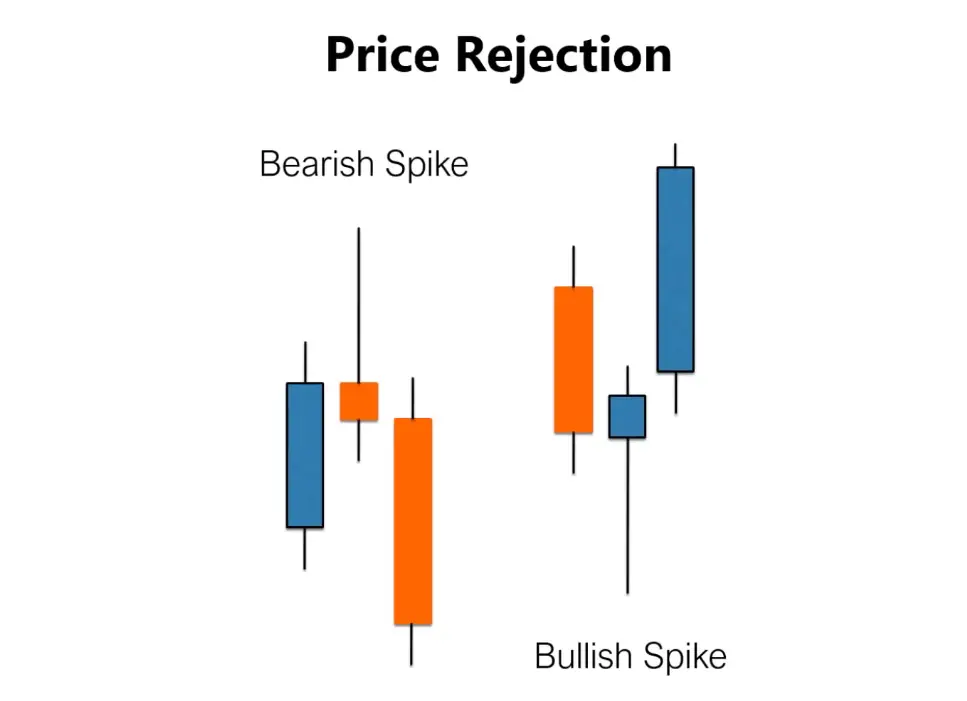

Refused candles are a type of candlestick pattern that signals a potential reversal in price direction. They occur when the market attempts to move in one direction but is quickly rejected, resulting in a sharp reversal. These candles often have long wicks or shadows, indicating that buyers or sellers stepped in to push the price back.

For example, if the price tries to move higher but is rejected, it forms a bearish candle. Conversely, if the price attempts to move lower but is rejected, it forms a bullish rejection candle. These patterns are particularly useful for identifying key support and resistance levels, as they highlight areas where the market has shown strong opposition to a price movement.

How to Identify Rejection Candles

Identifying thesecandles is relatively straightforward once you know what to look for. Here are the key characteristics:

- Long Wicks or Shadows: The candle will have a long upper wick (in a bearish rejection) or a long lower wick (in a bullish rejection).

- Small Body: The body of the candle is typically small, indicating that the price closed near its opening level.

- Context Matters: Are most meaningful when they appear at key support or resistance levels, trendlines, or Fibonacci retracement levels.

For instance, if you see a candle forming at a well-established resistance level, it could signal that the price is unlikely to break through that level, and a reversal may be imminent.

Types of Rejection Candles

Can be categorized into two main types:

- Bullish Rejection: These occur when the price attempts to move lower but is rejected, forming a long lower wick. This indicates strong buying pressure and suggests a potential upward reversal.

- Bearish Rejection : These occur when the price tries to move higher but is rejected, forming a long upper wick. This signals strong selling pressure and hints at a potential downward reversal.

Understanding these types can help you anticipate market movements and make better trading decisions.

How to Use Rejection Candles in Your Trading Strategy

Versatile and can be used in various trading strategies. Here’s how you can incorporate them into your approach:

1. Spotting Trend Reversals

Excellent indicators of potential trend reversals. If you notice a rejection forming after a prolonged uptrend or downtrend, it could signal that the trend is losing momentum and a reversal is on the horizon.

2. Confirming Support and Resistance Levels

When it forms at a key support or resistance level, it strengthens the validity of that level. For example, if the price bounces off a support level and forms a bullish rejection, it confirms that the support level is holding strong.

3. Combining with Other Indicators

To increase the accuracy of your trades, consider combining reject candles with other technical indicators like moving averages, RSI, or MACD. This multi-faceted approach can help you confirm signals and reduce the risk of false breakouts.

4. Setting Stop-Loss and Take-Profit Levels

Can also help you determine optimal stop-loss and take-profit levels. For instance, if you enter a trade based on a bullish re-jection candle, you might place your stop-loss just below the candle’s low and your take-profit near the next resistance level.

Common Mistakes to Avoid When Using

While it powerful method of candle reading, they are not foolproof. Here are some common mistakes to avoid:

- Ignoring Market Context: Always consider the broader market context when analyzing rejection candle. A this type of candle in isolation may not be as meaningful as one that forms at a key level or during a significant market event.

- Overlooking Confirmation: Don’t rely solely on refused. Always look for additional confirmation from other indicators or price action patterns.

- Chasing Trades: Avoid entering trades based on rejection candles that have already fully formed. Wait for the next candle to confirm the reversal before taking action.

Practical Tips for Trading with Rejection Candles

Here are some actionable tips to help you make the most of rejection candles:

- Practice Patience: Wait for rejection candles to fully form before making any trading decisions. Premature entries can lead to losses.

- Use Multiple Timeframes: Analyze rejection candles on higher timeframes for more reliable signals. For example, a rejection candle on a daily chart carries more weight than one on a 5-minute chart.

- Keep a Trading Journal: Record your trades and note how rejection candles influenced your decisions. This will help you refine your strategy over time.

Conclusion

Rejection candles are a valuable tool for traders and investors looking to understand market sentiment and identify potential reversals. By learning how to spot and interpret these patterns, you can enhance your trading strategy and make more informed decisions. Remember to combine rejection candles with other technical analysis tools and always consider the broader market context.

Now that you know the power of rejection candles, why not start incorporating them into your trading strategy? Practice identifying these patterns on your charts and see how they can improve your results.

Take Action

- Have you ever used rejection candles in your trading strategy? How did it work out for you?

- What’s your favorite technical indicator to combine with rejection candles?

- Ready to take your trading to the next level? Start practicing with rejection candles today and share your results in the comments below!

Leave a Reply