How to Trade Earnings Report Day: A Beginner’s Guide to Investing and Trading

Earnings report day is one of the most anticipated events in the stock market. For investors and traders, it’s a golden opportunity to capitalize on price movements and make informed decisions. But how do you trade earnings report day effectively? In this guide, we’ll walk you through everything you need to know, from preparation to execution, so you can navigate this high-stakes event with confidence.

Table of Contents

What Is Earnings Report Day?

Earnings report day is when a publicly traded company releases its financial performance for the previous quarter. These reports include key metrics like revenue, earnings per share (EPS), and guidance for future performance. For traders and investors, this is a critical moment because the market often reacts strongly to the results.

When you trade earnings report day, you’re essentially betting on whether the company’s performance will exceed, meet, or fall short of market expectations. The goal is to predict how the stock price will move and position yourself accordingly.

Why Earnings Reports Matter

Earnings reports provide a snapshot of a company’s financial health. They reveal how well the business is performing and whether it’s on track to meet its goals. For traders, this information is invaluable because it can lead to significant price swings.

Here’s why earnings reports are so important:

- Market Sentiment: Positive earnings can boost investor confidence, while negative results can lead to sell-offs.

- Volatility: Earnings reports often cause sharp price movements, creating opportunities for profit.

- Insights into Growth: Reports offer clues about a company’s future prospects, helping you make long-term investment decisions.

If you want to trade earnings report day successfully, understanding these dynamics is crucial.

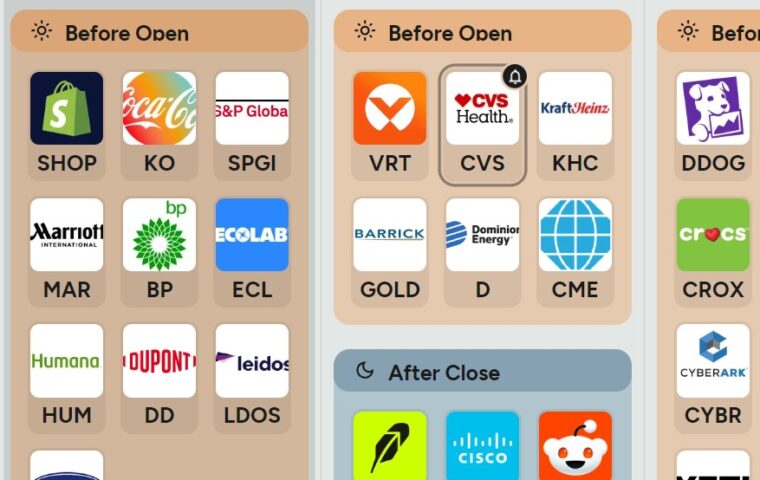

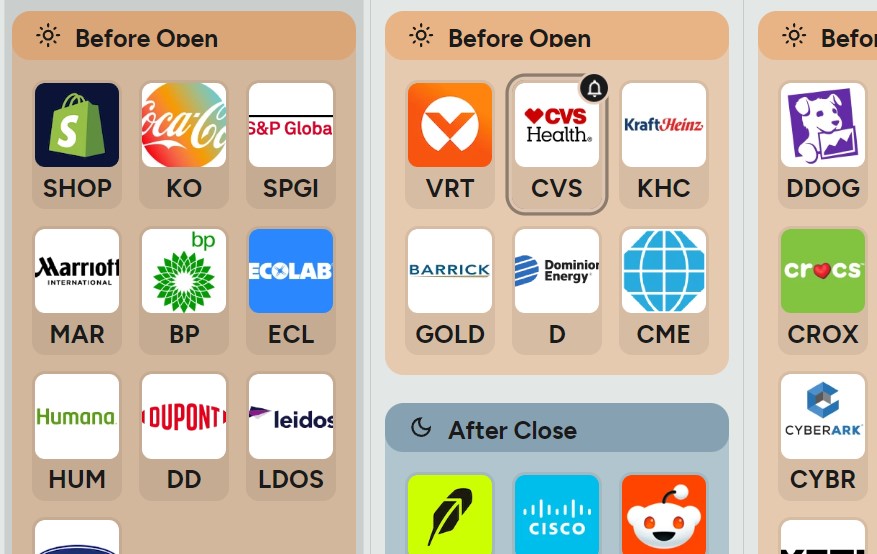

How to Prepare for Earnings Report Day

Preparation is key when it comes to trading earnings report day. Here’s a step-by-step guide to help you get ready:

1. Research the Company

Start by analyzing the company’s past earnings reports. Look for trends in revenue, profit margins, and guidance. This will give you an idea of what to expect.

2. Understand Market Expectations

Analysts’ estimates play a big role in how the market reacts. If a company beats expectations, the stock price may surge. If it misses, the price could drop. Make sure you know what the consensus estimates are before the report.

3. Check the Stock’s Historical Performance

Some stocks tend to rise after earnings, while others fall. Look at how the stock has reacted to past earnings reports to gauge potential outcomes.

4. Set Clear Goals and Risk Management Rules

Decide in advance how much you’re willing to risk and what your profit targets are. This will help you stay disciplined during volatile trading.

Strategies for Trading Earnings Report Day

Now that you’re prepared, let’s dive into some strategies to help you trade earnings report day effectively.

1. The Pre-Earnings Play

This strategy involves buying or selling a stock before the earnings report is released. The idea is to capitalize on the anticipation and speculation driving the price.

- Pros: You can benefit from pre-earnings momentum.

- Cons: The actual report may not align with market expectations, leading to losses.

2. The Post-Earnings Drift

Some stocks continue to move in the same direction for days or weeks after the earnings report. This is known as the post-earnings drift.

- Pros: You can ride the trend for extended gains.

- Cons: The drift may reverse unexpectedly, so stay vigilant.

3. Options Trading

Options allow you to bet on a stock’s price movement without owning the underlying asset. For example, you can buy a call option if you expect the stock to rise or a put option if you expect it to fall.

- Pros: Limited risk with high reward potential.

- Cons: Options can expire worthless if the stock doesn’t move as expected.

4. Straddle Strategy

A straddle involves buying both a call and a put option with the same strike price and expiration date. This strategy works well when you expect a big price move but aren’t sure of the direction.

- Pros: You can profit from significant volatility.

- Cons: The stock must move enough to cover the cost of both options.

Common Mistakes to Avoid

Trading earnings report day can be lucrative, but it’s also risky. Here are some common mistakes to avoid:

- Overleveraging: Don’t risk more than you can afford to lose. Earnings reports are unpredictable, and even the best strategies can fail.

- Ignoring Guidance: The company’s future outlook is just as important as its past performance. Pay attention to guidance.

- Chasing the News: Avoid making impulsive decisions based on headlines. Stick to your plan.

- Failing to Exit: Have a clear exit strategy. Don’t hold onto a losing position hoping it will turn around.

Final Thoughts

Trading earnings report day can be both exciting and rewarding, but it requires careful planning and execution. By researching the company, understanding market expectations, and using proven strategies, you can increase your chances of success.

Remember, the key to trading earnings report day is to stay disciplined and manage your risk. Don’t let emotions drive your decisions, and always have a plan in place.

Now it’s your turn! Have you ever traded earnings report day? What strategies worked best for you? Share your experiences in the comments below we’d love to hear from you!

Leave a Reply