How to Use Elliott Wave Theory for Investing & Trading

Elliott Wave Theory is a powerful tool for analyzing financial markets and making informed trading decisions. Whether you’re a beginner or an experienced trader, understanding this theory can help you identify trends, predict market movements, and improve your investment strategy. In this article, we’ll break down the basics of Elliott Wave Theory, explain how to apply it, and provide actionable tips for using it in your trading journey.

Table of Contents

What is Elliott Wave Theory?

Elliott Wave Theory is a technical analysis approach developed by Ralph Nelson Elliotthttps://en.wikipedia.org/wiki/Ralph_Nelson_Elliott in the 1930s. It’s based on the idea that market prices move in repetitive cycles, which are influenced by investor psychology. These cycles consist of waves—specifically, impulse waves that move in the direction of the trend and corrective waves that move against it.

By understanding these patterns, you can anticipate where the market might head next. This makes Elliott Wave Theory a valuable tool for traders and investors looking to capitalize on market trends.

The Basics of Elliott Wave Patterns

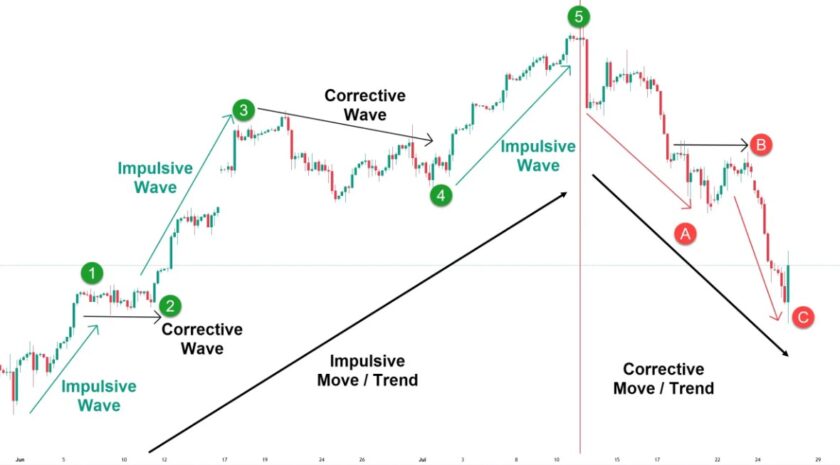

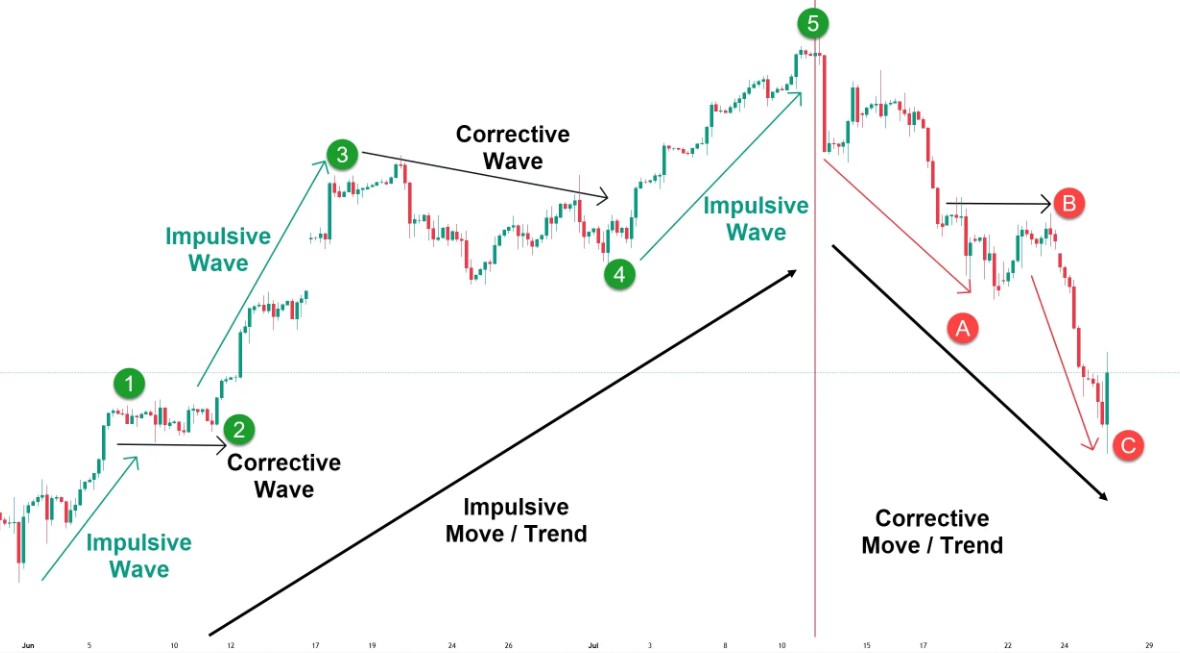

Impulse Waves

Impulse waves are the main drivers of market trends. They consist of five smaller waves, labeled 1 through 5. Waves 1, 3, and 5 move in the direction of the trend, while waves 2 and 4 are smaller corrections against the trend.

- Wave 1: The initial move in the direction of the trend.

- Wave 2: A partial retracement of Wave 1.

- Wave 3: Often the longest and strongest wave, extending the trend.

- Wave 4: Another correction, usually smaller than Wave 2.

- Wave 5: The final push in the direction of the trend.

Corrective Waves

Corrective waves, also known as pullbacks, move against the trend. They typically consist of three smaller waves, labeled A, B, and C.

- Wave A: The first move against the trend.

- Wave B: A partial retracement of Wave A.

- Wave C: The final move, often extending beyond Wave A.

Understanding these patterns is key to applying Elliott Wave Theory effectively.

How to Apply Elliott Wave Theory in Trading

Identifying Wave Patterns

The first step in using Elliott Wave Theory is learning to identify wave patterns on price charts. Start by analyzing historical price movements to spot impulse and corrective waves. Look for the five-wave impulse pattern followed by a three-wave corrective pattern.

- Use trendlines to connect highs and lows.

- Pay attention to volume and momentum indicators to confirm wave patterns.

Setting Entry and Exit Points

Once you’ve identified a wave pattern, you can use it to set entry and exit points for your trades.

- Entry Points: Consider entering a trade at the start of Wave 3, which is often the most profitable part of the trend.

- Exit Points: Plan to exit your trade at the end of Wave 5 or during the corrective Wave C.

By aligning your trades with these waves, you can maximize your profits and minimize risks.

Common Mistakes to Avoid

While Elliott Wave Theory can be highly effective, it’s not without its challenges. Here are some common mistakes to watch out for:

- Overcomplicating the Analysis: Stick to the basics and avoid trying to identify too many sub-waves.

- Ignoring Market Context: Always consider the broader market trend and economic conditions.

- Failing to Use Confirmation Tools: Use other indicators like RSI or MACD to confirm your wave counts.

Tips for Success with Elliott Wave Theory

- Practice Patience: Wave patterns take time to develop. Don’t rush your analysis.

- Combine with Other Tools: Use Elliott Wave Theory alongside other technical indicators for better accuracy.

- Stay Disciplined: Stick to your trading plan and avoid emotional decisions.

- Keep Learning: Continuously refine your skills by studying charts and market behavior.

Conclusion

Elliott Wave Theory is a versatile and powerful tool for traders and investors. By understanding wave patterns and applying them to your trading strategy, you can gain a deeper insight into market trends and make more informed decisions. Remember, like any trading method, it requires practice and patience to master.

So, are you ready to start using Elliott Wave Theory in your trading? Take the time to study the patterns, apply what you’ve learned, and see how it can transform your approach to the markets.

Meta Description

Learn how to use Elliott Wave Theory for investing and trading. Discover wave patterns, tips, and strategies to improve your market analysis and decision-making.

SEO Title

How to Use Elliott Wave Theory for Investing & Trading: A Complete Guide

Now it’s your turn—have you tried using Elliott Wave Theory in your trading? Share your experiences or questions in the comments below!

Leave a Reply