Mastering the Wyckoff Pattern

If you’re looking to improve your trading and investing strategies, understanding the Wyckoff pattern can be a game-changer. This powerful method, developed by Richard Wyckoff, helps you analyze market trends and make informed decisions. In this article, we’ll break down the this awesome pattern, explain how it works, and show you how to use it effectively in your trading journey.

Table of Contents

What is the Wyckoff Pattern?

Technical analysis tool used to identify market trends and predict future price movements. Named after Richard Wyckoff, a pioneer in the field of technical analysis, this method focuses on understanding the relationship between supply and demand. By studying price action and volume, the advance pattern helps traders spot potential buying and selling opportunities.

This pattern is especially popular among stock and cryptocurrency traders because it provides a clear framework for analyzing market behavior. Whether you’re a beginner or an experienced trader, mastering the Wyckoff pattern can give you an edge in the markets.

How the Wyckoff Pattern Works

At its core, the Wyckoff pattern is based on the idea that markets move in cycles. These cycles are driven by the actions of large institutional players, often referred to as “smart money.” By identifying the phases of accumulation and distribution, you can align your trades with the smart money and increase your chances of success.

Relies on three key principles:

- Supply and Demand: Prices move based on the balance between supply and demand.

- Effort vs. Result: Volume indicates the effort behind price movements, helping you confirm trends.

- Cause and Effect: Accumulation and distribution phases create the cause, leading to price movements (the effect).

Key Phases of the Wyckoff Pattern

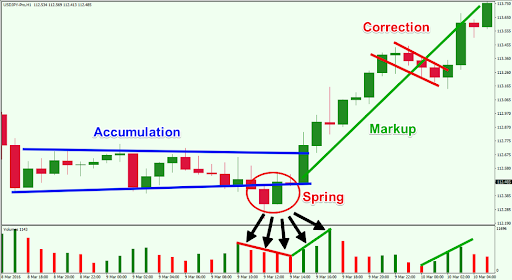

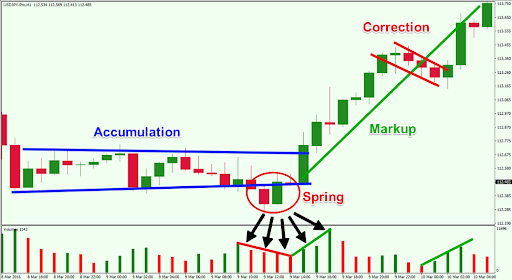

The Wyckoff pattern consists of four main phases: accumulation, markup, distribution, and markdown. Let’s explore each phase in detail.

1. Accumulation Phase

During the accumulation phase, smart money players quietly accumulate positions while retail traders remain unaware. This phase is characterized by sideways price action and low volatility. Key signs of accumulation include:

- A defined trading range.

- Decreasing volume as the phase progresses.

- A “spring” or false breakdown below support, signaling the end of accumulation.

2. Markup Phase

The markup phase begins when smart money starts pushing prices higher. This phase is marked by strong upward momentum and increasing volume. As a trader, this is the ideal time to enter long positions.

3. Distribution Phase

In the distribution phase, smart money begins selling their positions to retail traders. Prices often move sideways, similar to the accumulation phase, but with subtle differences. Look for:

- A defined trading range with resistance holding strong.

- Decreasing volume as the phase progresses.

- A “upthrust” or false breakout above resistance, signaling the end of distribution.

4. Markdown Phase

The markdown phase is when prices fall sharply as supply overwhelms demand. This phase is characterized by high volume and downward momentum. Traders should avoid entering long positions during this phase.

Applying the Wyckoff Pattern in Trading

Now that you understand the phases, let’s discuss how to apply it in your trading strategy.

Step 1: Identify the Phase

Start by analyzing the current market structure to determine which phase the asset is in. Use price action and volume to confirm your analysis.

Step 2: Look for Confirmation

Before making a trade, wait for confirmation signals. For example, during the accumulation phase, look for a spring or a breakout above resistance with increasing volume.

Step 3: Manage Risk

Always use proper risk management techniques. Set stop-loss orders and position sizes based on your risk tolerance.

Step 4: Monitor the Market

Stay vigilant and monitor the market for changes in trend. The pattern is dynamic, and phases can shift quickly.

Common Mistakes to Avoid

While the Wyckoff pattern is a powerful tool, it’s easy to make mistakes if you’re not careful. Here are some common pitfalls to avoid:

- Overtrading: Don’t force trades if the market doesn’t align with the Wyckoff pattern.

- Ignoring Volume: Volume is a critical component of the pattern. Always analyze volume alongside price action.

- Failing to Confirm: Never enter a trade without confirmation signals. Patience is key.

Tips for Success

To maximize your success with the Wyckoff pattern, keep these tips in mind:

- Practice Patience: Wait for clear signals before entering a trade.

- Use Multiple Timeframes: Analyze the Wyckoff pattern on different timeframes to get a broader perspective.

- Combine with Other Tools: Use alongside other technical indicators for better accuracy.

- Stay Disciplined: Stick to your trading plan and avoid emotional decisions.

Conclusion

The Wyckoff pattern is a valuable tool for traders and investors looking to understand market trends and make smarter decisions. By mastering the phases of accumulation, markup, distribution, and markdown, you can align your trades with the actions of smart money and improve your results.

Remember, success with the this pattern requires practice, patience, and discipline. Start by analyzing historical charts and gradually apply the method to your live trading. Over time, you’ll develop a deeper understanding of market behavior and enhance your trading skills.

Have you tried using the Wyckoff pattern in your trading? Share your experiences or questions in the comments below! Let’s learn and grow together.

Read this Candle pattern story

Leave a Reply